If you are looking for a comprehensive Accounting and Taxation Course in Delhi—complete with Certified GST and Custom Practitioner modules, a formal 100% job guarantee, and free SAP HANA Finance training—SLA Consultants Delhi offers a future-ready career pathway recognized by industry and employers alike.

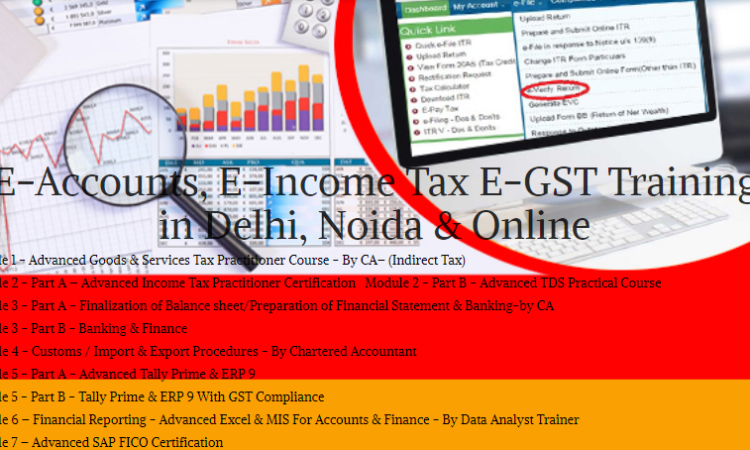

The curriculum is industry-oriented and meticulously structured, starting with the foundations of e-Accounts, e-Taxation, income tax (ITR 1–7), and direct and indirect tax. It then delves into expert-level modules on GST practitioner work, advanced TDS, customs and import-export procedures, financial statement preparation, balance sheet finalization, and banking and MIS reporting in Excel. Hands-on assignments, real-time case studies, and live projects are emphasized, ensuring that you’re ready not just for exams but also for immediate entry into corporate and consulting roles. The institute’s faculty comprises Chartered Accountants and senior industry consultants, each with over a decade of experience, bringing real-world scenarios into every classroom session.

A standout feature is the Certified GST and Custom Practitioner track. This module imparts practical skills in GST law, e-filing, return preparation (GSTR-1, 3B, 9), audit requirements, input tax credit, e-invoicing, and real customs documentation aligned with current government regulations and trade environments. The inclusion of a dedicated customs module—covering import/export procedures, ICEGATE, and duty calculations—makes the course especially suitable for those targeting trade finance, regulatory consulting, or cross-border business roles. Every graduate receives recognized certifications for both GST and customs practice, boosting employability as a tax or trade compliance professional.

SLA Consultants Delhi’s 100% job guarantee is presented through a transparent placement process. After you complete 70% of the course modules, their dedicated placement cell begins scheduling interviews with over 500 MNCs, finance consultancies, and top corporates. Placement support includes resume workshops, corporate etiquette, interview training, and networking connections, continuing until you are placed in a suitable role. The placement process is formalized with a written agreement, giving you unmatched career assurance on successful completion.

Included within your training, at no extra cost, is the Free SAP HANA Finance (SAP FICO) Course. This module is taught by SAP-certified experts and exposes you to hands-on configuration, asset accounting, financial automation, reporting, and analytics using live SAP S/4 HANA environments. This globally benchmarked ERP certification is highly sought after by MNCs and digitally transformed organizations, providing an edge for high-growth roles in accounting, finance analytics, and ERP consulting.

Finally, flexibility is central to this program—choose from weekday, weekend, online, or offline batches at branches throughout Delhi. Ongoing admin support, regular curriculum updates, and a practical learning environment ensure you’re fully prepared for today’s competitive job market. Upon completion, you earn multiple certifications—Accounting Institute in Delhi & Taxation, Certified GST & Custom Practitioner, and SAP HANA Finance—demonstrating a skill set valued by the top employers in the finance sector for 2025 and beyond.

Opting for SLA Consultants means investing in hands-on learning, regulatory confidence, modern ERP expertise, and a job-backed future in accounting and taxation in Delhi.

SLA Consultants Accounting and Taxation Course in Delhi, Certified GST and Custom Practitioner Course in Delhi, 100% Job Guarantee Course by “SLA Consultants”” Free SAP HANA Finance Course, details with New Year Offer 2025 are available at the link below:

https://slaconsultantsdelhi.in/training-institute-accounting-course/

https://slaconsultantsdelhi.in/sap-fico-training-course-institute/

Certified Taxation, Accounting, Finance CTAF Course

Module 1 – Advanced Goods & Services Tax Practitioner Course – By CA – (Indirect Tax)

Module 2 – Part A – Advanced Income Tax Practitioner Certification

Module 2 – Part B – Advanced TDS Practical Course

Module 3 – Part A – Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 – Part B – Banking & Finance

Module 4 – Customs / Import & Export Procedures – By Chartered Accountant

Module 5 – Part A – Advanced Tally Prime & ERP 9

Module 5 – Part B – Tally Prime & ERP 9 With GST Compliance

Module 6 – Financial Reporting – Advanced Excel & MIS For Accounts & Finance – By Data Analyst Trainer

Module 7 – Advanced SAP FICO Certification

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/